UNLOCK THE WORLD-CLASS PLUG AND PLAY APPLICATION FUNNEL RESPONSIBLE FOR OVER $10,000,000 IN HIGH TICKET SALES...

STEAL THE PLUG & PLAY "QPC FUNNEL" RESPONSIBLE FOR JAM PACKING CALENDARS, AND GENERATING OVER 8-FIGURES IN HIGH TICKET SALES...

We Help Online Education Businesses Scale to 7 And 8-Figures with YouTube Ads

SOCIAL Insight

Apply Now

We Only Help Online Education Businesses

THE MOST SOUGHT AFTER Meta Ads Agency IN THE ENTIRE DTC INDUSTRY

THE MOST SOUGHT AFTER Meta Ads Agency IN THE ENTIRE DTC INDUSTRY

Ready to Scale Past 7 And 8-Figures?

Ready to Scale Past 7 And 8-Figures?

Have your Meta ad results been on a constant decline or frustratingly stagnant? Get campaigns that convert from the same agency who's been hired by industry giants like

Athletic Greens, General Mills, Look Optic, Procter & Gamble, Madluvv, and many many more...

Have your Meta ad results been on a constant decline or frustratingly stagnant? Get campaigns that convert from the same agency who's been hired by industry giants like

Athletic Greens, General Mills, Look Optic, Procter & Gamble, Madluvv, and many many more...

WHO HAVE We HAVE Helped?

UNLOCK THE WORLD-CLASS PLUG AND PLAY APPLICATION FUNNEL RESPONSIBLE FOR OVER $10,000,000 IN HIGH TICKET SALES...

STEAL THE PLUG & PLAY "QPC FUNNEL" RESPONSIBLE FOR JAM PACKING CALENDARS, AND GENERATING OVER 8-FIGURES IN HIGH TICKET SALES...

We Help Online Education Businesses Scale to 7 And 8-Figures with YouTube Ads

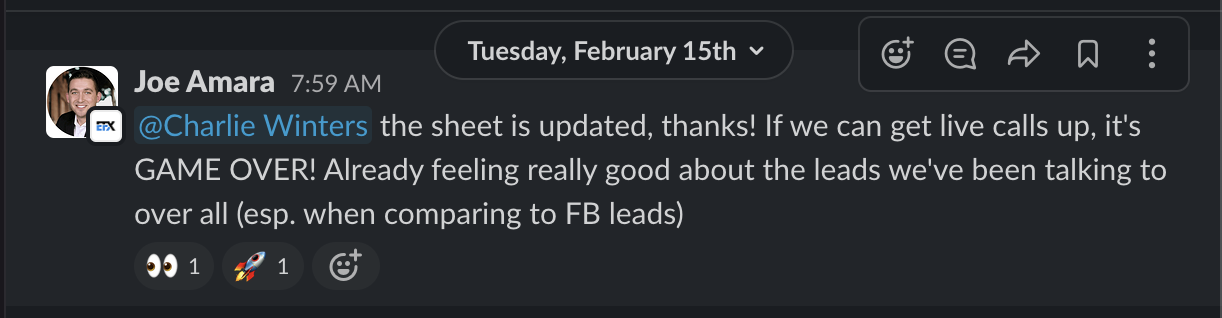

Client Testimonials

WHY Industry Leaders TRUST US

"Brian is in my mastermind, and when we get to the YouTube Ads parts of the mastermind, I sit down, and I let him come up to speak about it. He is passionate about YouTube Ads, he loves it, it's his craft, he's very good at it, and he knows all of the best strategies, tactics and everything right now. And he knows how to get YouTube Ads to work for other people not just himself."

Sam Ovens

Founder of Consulting.com

"I have tons of friends in the YouTube Ads space, and I've bought pretty much every course and information product available for YouTube Ads... and just working with Brian has been BY FAR the MOST helpful insights I've ever gotten on YouTube period!"

Cole Gordon

8-Figure Sales Trainer

"Instead of trying to master it myself... Why not just get the masters to do it for me, and that's what I did! I started working with Adspend, Immediately our revenue shot up and since we have been working with Adspend our total gross revenue has increased 20% we never seen our ROAS as high as it is now after working with Adspend."

Brandon Carter

Founder of High Ticket Trainer

" We brought on Adspend to really help launch our YouTube ads. Within about three months, we've added an additional $800k of revenue, we've only had to spend a little over $200k to do that so its around a 4x ROAS just started in YouTube. "

Jeremy Miner

Founder of The 7th Level

"Seriously if you're talking to Brian and the guys and talking to other people, don't bother! These guys are phenomenal alright? They are responsive, friendly, fun to work with and more importantly above all they're great people and help us make a ton of money, they're amazing. Brian is the Tony Robbins of YouTube Ads "

Charlie Morgan

Founder of The Imperium Agency

"I met Brian at a Mastermind, This is a no brainer I need to work with these guys. Since launching on October 6th we have spent $308k and we have generated $969k in revenue, So within six months we've generated just under a million dollars and have seen a 3.15 ROAS. I cannot say enough good things about these guys"

Sarah Turner

CEO of Sarah Turner Agency

"You guys are doing a FANTASTIC job getting us all those leads every single month, Thank you for everything you guys do for us!"

Bedros Keuilian

CEO of Fit Body Boot Camp

"Brian and his team have been nothing but stellar in everything they've done for us, from writing the scripts to putting the whole strategy together, to executing the media buying... really really happy with you guys!

Roland Frasier

Co-Founder of Digital Marketer

"We're spending over $100,000/month and we are PROFITABLE, PROFITABLE, PROFITABLE. I'm happy, my team is happy and they have really bent over backwards to help us!"

John Asaraf

CEO of Neuro Gym

We just had one of the best promotions we ever had in 11-years of being online, and that was primarily because of the YouTube marketing strategy. We're looking at a return of Adspend in the realm of like a 4X return on the front end!"

Nick Unsworth

CEO of Life On Fire

"Within the first 30-days we were able to be either profitable on the front end, or break even. And right now, we're spending around $8,000-$10,000/month on Ads, and we're looking to scale up even more in these next few months!"

Tapp Brothers (PART 1)

Over 1.2m YouTube subscribers

"Now we're up to $100,000/month Adspend, and profitable! Some days we're hitting around $2-3k a day PROFIT, on the front end!"

Tapp Brothers (PART 2)

Over 1.2m YouTube subscribers

Why Should

You Book A Call With Us Today?

Why WORK With Us?

Over $200M Spent on Meta Ads for DTC Brands

Lorem ipsum dolor sit amet, consectetur adipisicing elit. Autem dolore, alias, numquam enim ab voluptate id quam harum ducimus cupiditate similique quisquam et deserunt, recusandae.

Beauty, supplements, fashion, electronics, we have done it all! We know your niche and we know the path to massive DTC profitability with Meta.

Stop guessing and stop stressing! What's working at scale on Meta changes monthly. Since all we do is Meta ads we leverage what we are seeing in every account we manage to cut the guess work out of what will work at scale.

Discover the 8-figure Meta Ads "TSW" system we use to help our clients get consistent sales while increasing ad spend and improving ROAS.

Would We MAKE

A Good Fit?

Truth Is We Are NOT A Good Fit For Most Businesses...

Truth Is We Are NOT A Good Fit For Most Businesses & Entrepreneurs...

WE WILL HELP

6, 7, and 8-figure DTC brands who sell products that they warehouse and fulfill from the US. (No drop shipping brands)

DTC brands who are already running paid ads on Meta, but can't scale or hit their goals and need more efficiency out of their Meta spend.

DTC brands that were previously crushing it with Facebook ads but have been on a constant decline.

WE WON'T HELP

New brands or products that have yet to be tested to the marketplace. If you are looking to START advertising, we're not the best fit for you.

Businesses with falling sales and unprofitable campaigns that are looking to be saved by an agency. We don't save businesses... we SCALE them.

Businesses that sell black-hat products, services, or goods that don't actually help the person who's buying. We won't advertise what we won't buy ourselves.

SOUND LIKE A FIT?

*Lets Start by Connecting

Case Study

Creating & Scaling YouTube Ads For The Biggest Names In The Industry

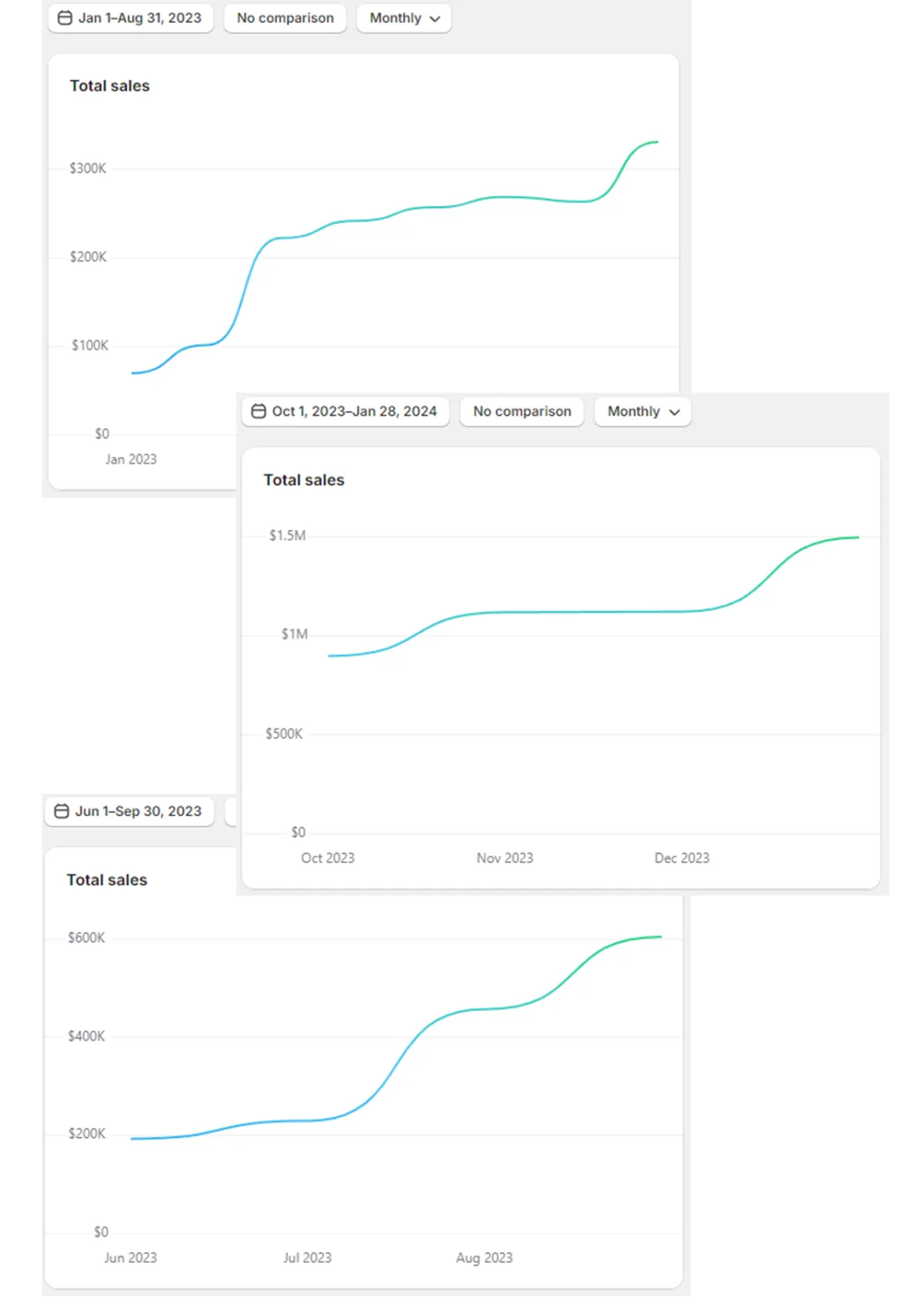

Scaling Look Optic from $8,000/day to $22,000/day in profitable ad spend.

Brand

Look Optic is a prestige eyewear brand that helps make wearing readers a fun, fashionable and fearless experience.

Challenge

While they were doing well in market expansion, Look Optic struggled to acquire new customers profitably at scale. They were spending $240,000+ per month, but it wasn’t profitable. And their target metric — new customer return on ads spend (NCROAS) — was just 140%. Leaving them under break even after cost of goods (COGs)

Then in June 2023, Look Optic started working with us at Advengers.io, where we quickly established 2 goals: 1) Get acquisition profitable, and 2) Increase ad spend.

Solution

To do that, we started with an in-depth audit of their ad account. This helped us identify 2 opportunities for increasing profitability and spend.

First, we mapped out several new customer segments to help us reach untapped audiences. Then, we created new messaging based on these segments. These 2 steps assured we were getting the messaging in front of the right customers.

Lastly, we completely overhauled the ad account structure. We broke out audiences and increased the number of ad sets, and expanded to shop campaigns. This allowed us to scale the budget consistently, while building a durable ad account that wouldn’t suffer from big dips in spend when a single campaign fatigued.

Results

In January 2024, we were up to $22,000/day in profitable spend through just Meta at a 200% NCROAS.

While normally you have to choose between increasing spend or ROAS, we were able to do the (almost) impossible:

We scaled the budget while boosting profitability.

200%

New Customer Return On Ad Spend

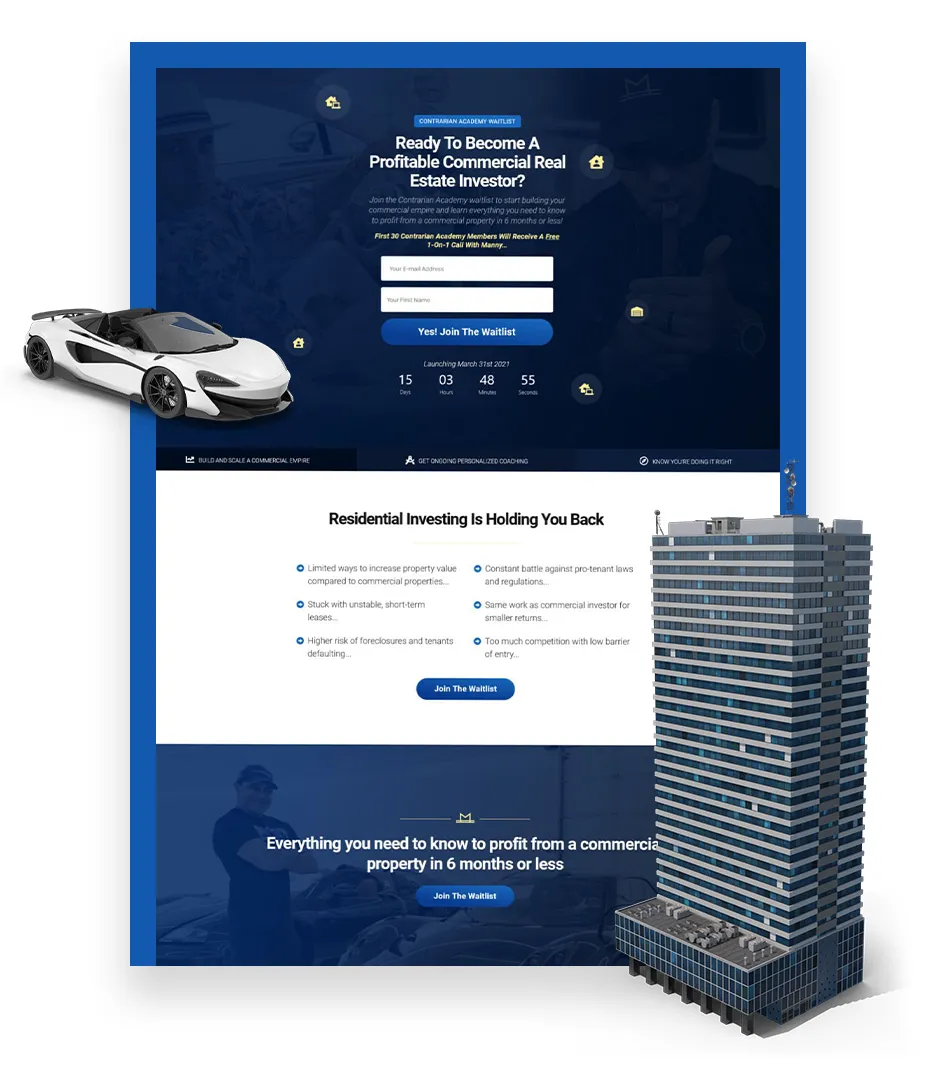

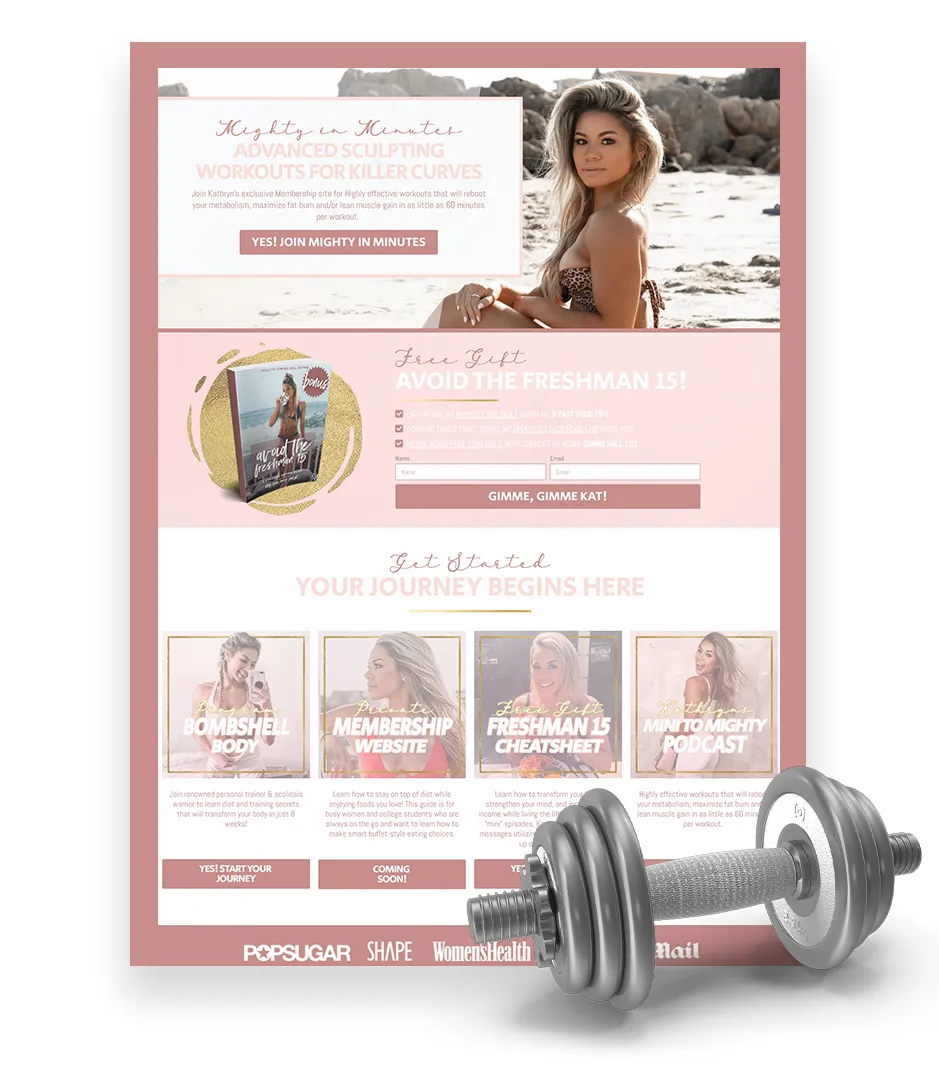

Built to Convert

Check Out The Previous Work We Have Built For Our Clients

Bedros Keuilian

Kinobody

The Wolf

Manny Khoshbin

Katherine Nash

Vince Delmonte

Pete Vargas

Bedros Keuilian - Squire

The Crop Collective

Erin Alejandrino

Pedro Adao

The Etsy Expert

If You Are Looking to Scroll for a While

HERE’S MORE CASE STUDIES & RESULTS

HYROS Certified Agency

"I was recently talking to Brian Moncada of Adspend.com (same agency that manages The Wolf Of Wall Street) and they are absolutely NUKING it using HYROS data with Call Funnels!"

Alex Becker

CEO of HYROS

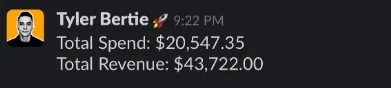

1,500 Leads @ $6 CPL with YouTube Ads - 3x ROAS

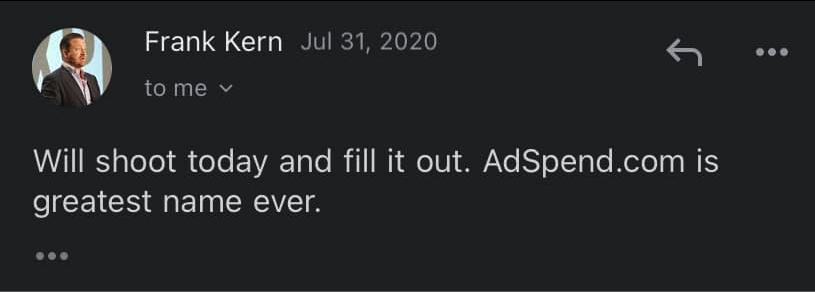

"Brian is the YouTube Ads dude I was telling you about, does a great job!"

Frank Kern

World Famous Internet Marketer & Copywriter

From selling low-ticket sales courses on Shopify, to generating a 2x ROAS with YT Ads, on the front-end.

Jordan Belfort

The "Wolf of Wall Street"

From spending $0 on YT Ads to profitably spending $100k /month on YouTube Ads with a 4x ROAS

"We're spending over $100,000/month and we are PROFITABLE, PROFITABLE, PROFITABLE. I'm happy, my team is happy and they have really bent over backwards to help us!"

John Asaraf

CEO of Neuro Gym

From $300k/ month to $500k/ month within 6-months

"We used to just scale our business with FB Ads but we were having trouble finding those low cost per leads we used to get so I was introduced to the guys over at Adspend.com... The whole service was awesome, they scripted everything for us, guided us on the type of videos we were going to make... and we quickly scaled up to over $500,000/month and moved into a new office! By February we'll probably be closer to $700,000 in monthly recurring revenue and it's thanks to the guys over at Adspend.com... I'd recommend them to anybody!"

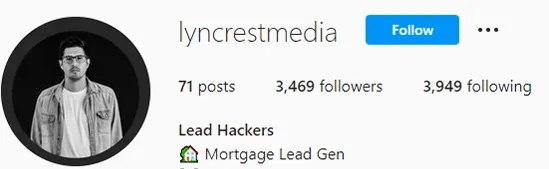

Alex Machuca - Lyncrest Media

Mortgage Marketing Agency

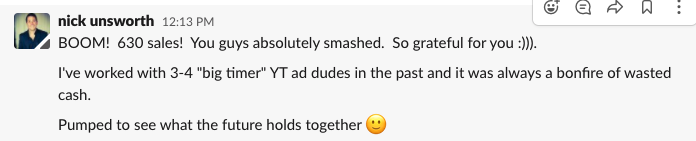

630 High-Ticket Sales From YouTube Ads - 4x ROAS on the front-end

"We just had one of the best promotions we ever had in 11-years of being online, and that was primarily because of the YouTube marketing strategy. We're looking at a return of Adspend in the realm of like a 4X return on the front end!"

Nick Unsworth

CEO of Life On Fire

Over 1,000 $997 course sales within 3-months using YT Ads

"If you know the power of YouTube Ads and YouTube is a game that you want to play... then Brian Moncada has the CHEAT CODES!

Caleb Maddix & Ryan O'Donnell

Youngest 2-Comma Club Winners in ClickFunnels History

From stuck relying on FB Ads, to booking an extra 45 calls per week and having leads PAY IN FULL on the 1st call with YT Ads

"These guys have been professionals through and through, our results have been amazing out of the gate with them, and we can see clearly our path to scale our company to 7-figure months because of the exposure and the value they were able to provide on Youtube!"

EasyFX Trading

Forex Trading Education Company

From $20k/month to $52k/month with 1 simple YT Ad

"I've worked with a variety of Ad agencies in the past for Facebook, Instagram and YouTube, but I've never worked with a single organization or individual as caring about my business as Brian is and was!"

Blake Bowman

Holistic Health & Fitness Coach

900 NEW customers every single month with YouTube Ads - 2-comma club award

"I've been doing online fitness for 12-years, we've used affiliates to increase traffic, facebook ads to increase traffic, and although those worked to some extent... nothing has worked the way these YouTube Ads and Brian and his team have to drive MORE traffic to my membership site!"

Funk Roberts

Body Transformation Coach For Men Over 40

So Many Sales, Had To Get A NEW Credit Card To Keep Spending

"Within like 3 or 4 weeks, Brian was surpassing my FB Ads guy... and generally YouTube Ads are more expensive than FB Ads... He got me so many sales of my book, we maxed out my credit card, so I had to get another credit card. We were growing so fast... Not only that, but he's just such a pleasure to work with..."

Jason Maxwell

Director of Marketing @ The Personal Trainer Development Center

Over $1.7m Generated with YouTube/Google Ads

"Before working with Brian & Adspend.com, I was relying solely on Facebook and sometimes we had good days, good weeks, or even good months... and other times we had the opposite happen and our sales fluctuated quite heavily! So I knew we needed some more traffic sources so I reached out to Brian and he was really able to help us. I've been with him for about 2 and 1/2 years now, we're spending multiple thousands of dollars a day on YouTube and Google.

Bryson Bilicek

Owner of Furry Freshness

From Banned by Facebook to $3,899/day with YouTube Ads

"Over the last 4-months I've had the opportunity to invest over $100,000 with Brian and his team on YouTube Ads traffic, which as really allowed us build out the front-end, and feed the back-end of our business. Prior to this, I was relying on ONE traffic source, just like a lot of people are right? It's Facebook and Instagram... you're inside that one ads manager, but then one day your account goes away and then things shift considerably. If you want to make MORE sales and have MORE impact... reach out to Brian and sign up with him immediately. It will be the best investment you make ALL year!"

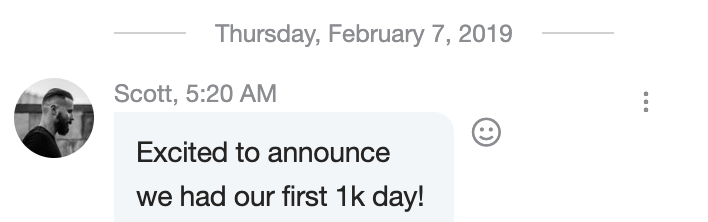

Scott Jack

Dating Coach For Men

3x ROI within the first 30-days

"I made back my investment, PLUS some, by the first month! Now we're just refining it, and I've even doubled and tripled my pricing since working with Brian. I'm super grateful for what you guys have done!"

Tyler Watson

Founder of Unstoppablepreneur

From only selling 5 Books per day, to 35 Books Per Day with YouTube Ads

Patrick James

Dating Coach For Men

From stuck relying on organic YT content to get clients, to profitably generating $8k/week with YouTube Ads

Michael Sasser

Boudoir Photographer

From breaking even on her YouTube Ads, to 2.3x ROAS after 30-days with just a few simple tweaks

Tamara Tee

Founder of Amazon FBA Winners

From $30k/month to $60k/month in LESS than 3-months

Camron James

Founder of Amazon Wealth Accelerators

From inconsistent lead flow with Organic traffic, to spending $8k on YT Ads and making back $33k in Revenue in 60-days

Clark Kegley

$1 million YouTube Subscribers

From stuck at $1k/day with YT Ads, to profitably scaling to $3k/day within 90-days

Mitch Gonsalves

Founder of Executive Advantage

From having trouble scaling past $100k/ months with FB Ads, to profitably scaling to $500k/months with YT Ads

Ashley Kinkead

Founder of Private Label Mastery

Ready To Scale?

So that we can be most efficient with your time we need to identify these 3 key pieces of information so we can provide you with tailored and effective insights on our brief call together

"Brian and his team have been nothing but stellar in everything they've done for us, from writing the scripts to putting the whole strategy together, to executing the media buying... really really happy with you guys!

"Brian and his team have been nothing but stellar in everything they've done for us, from writing the scripts to putting the whole strategy together, to executing the media buying... really really happy with you guys!

Roland Frasier

Co-Founder of Digital Marketer

I'LL GIVE YOU A LITTLE HINT...

High Ticket is the way...

Which is why I'm going to let you straight up STEAL my entire framework that I have optimized and refined with the biggest name in the industry...

I'll probably get some kickback from this but it'll be worth it in the end.